The outlook for the UK economy this year remains bleak. This is hampering a group of FTSE 100 stocks that are thought to be overexposed to Britain’s struggling economy. However, I think the long-term prospects for one dividend stock are being overlooked. Here’s why.

Underappreciated stock

The latest forecast from EY ITEM Club, a UK economic forecasting group, says a UK recession is likely to be deeper – but not longer – than previously expected. Then the economy is on course to grow again from the middle of 2023.

As a long-term investor, that doesn’t alarm me too much. Yet it seems financial services giant Legal & General (LSE: LGEN) has been marred by all this headline negativity. Despite the FTSE 100 rising 6% over the last year, L&G stock is down 7%.

Like domestic bank Lloyds, L&G has been lumped in with the wider UK economy. That’s understandable given its vast exposure to Britain’s economy with pensions and insurance. But that’s only part of the story.

LGIM, its investment management arm, is one of the largest in the world and the second-largest in Europe. It has assets under management of $1.6trn, as of June 2022. It is a major global investor, with an interest in the US, China, and Japan.

Additionally, half of L&G’s pension assets are international. In terms of insurance, it’s providing more coverage in the fast-growing Indian market. Plus, it’s expanding meaningfully into the US for the first time, where it has created a major life science and technology platform called Ancora L&G.

I expect this geographic expansion to offer growth opportunities in the years ahead. And as populations age in its key markets, its range of pension and annuity products are likely to be in high demand.

Massive yield

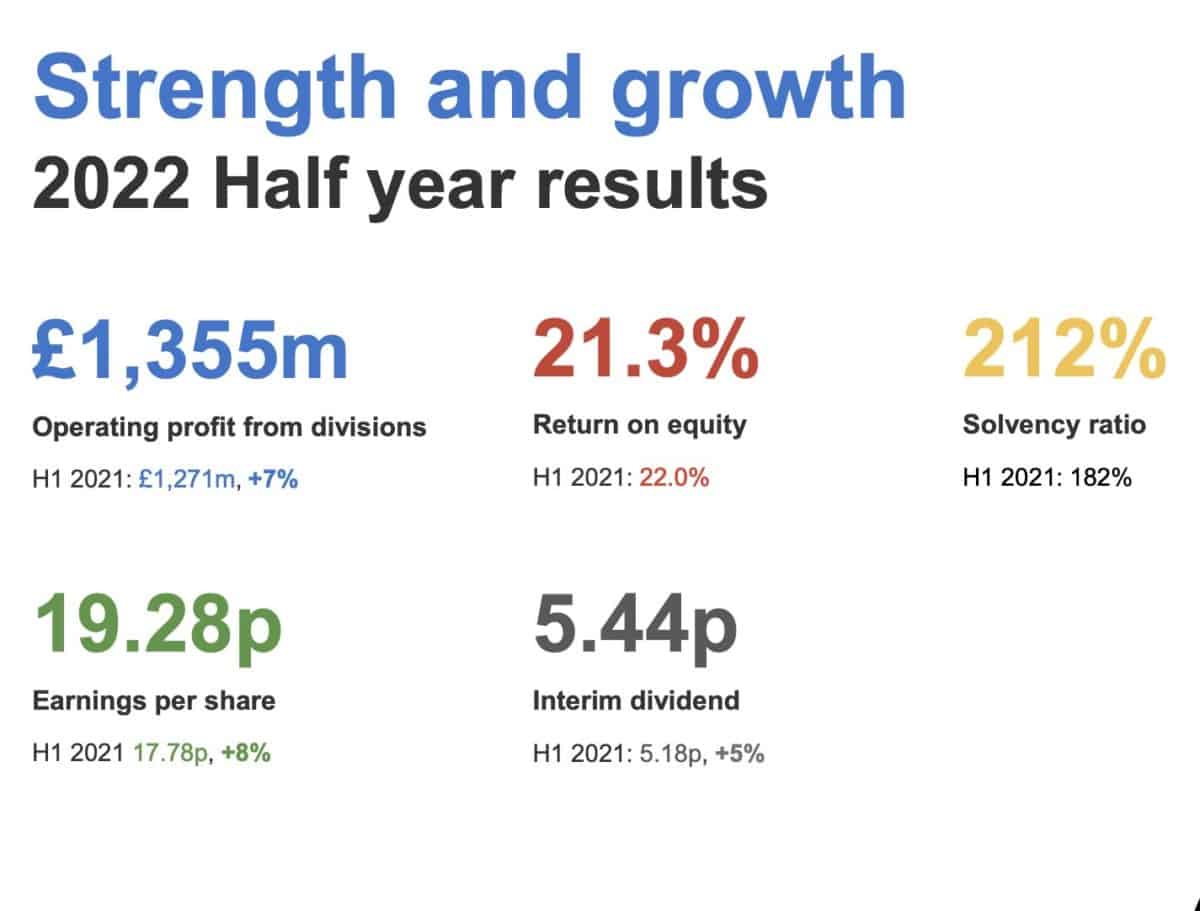

The company’s most recent H1 results, announced in August, were solid. It grew its operating profit, earnings, solvency ratio, and upped its dividend.

Yet the stock still looks cheap, with a price-to-earnings (P/E) ratio of 7.5. And the dividend yield for 2023 is now a massive 8%.

Of course, this large yield may indicate the firm could cut its payout. However, the fact that the dividend is covered 1.8 times by earnings gives me confidence that it’s safe for now.

The firm has a decades-long track record of growing its dividend. It’s basically a dividend machine, ideal for generating passive income.

Risks

The size of L&G’s various operations and increasing global presence does open up various risks. We saw in 2021 how the Chinese property market experienced entered severe financial stress. Though not affected by this partcular black swan, it shows how the company could encounter something similar in an international market to which it’s exposed.

However, L&G’s vast experience and pedigree in assessing such risk and complexity gives me peace of mind. There were no defaults in its annuity portfolios during the first half of last year. And it received 100% of scheduled cashflows from its direct investments. This is an extremely well-run business.

The stock is 260p today, which is the same price it was at in 2018. I plan to add to my holding very soon.